Health insurance is an important type of coverage that can protect you and your family from the financial impact of unexpected medical expenses.

Why do I need health insurance?

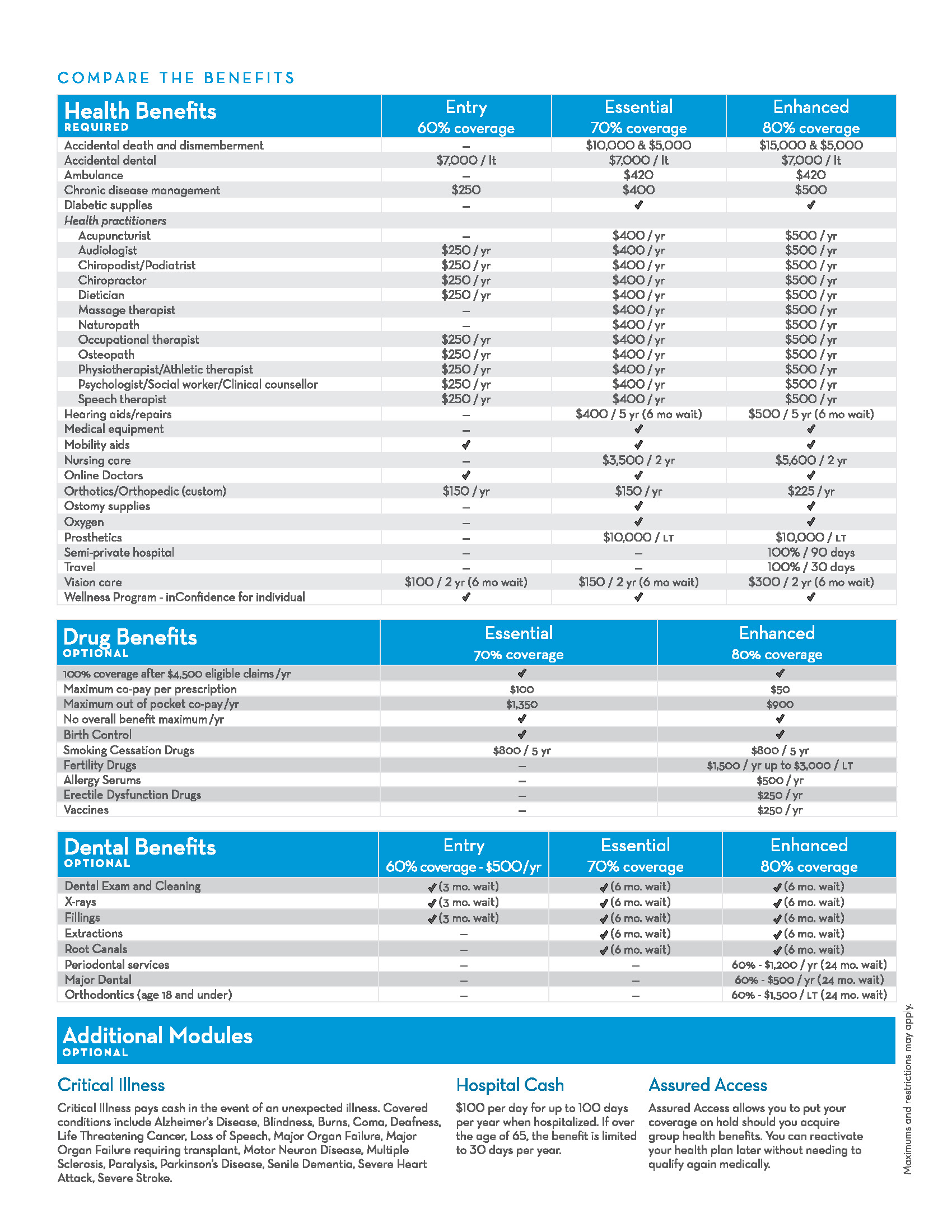

While Canada’s healthcare system is one of the best in the world, not all medical expenses are covered by the government. Individual health insurance can fill this gap and provide coverage for additional medical expenses, including prescription drugs, vision and dental care, and specialized treatments.

Health insurance in Canada typically covers a range of medical expenses, including:

- Prescription Drugs: Health insurance plans often cover the cost of prescription drugs prescribed by a doctor or specialist. This can include medications for chronic conditions, as well as short-term treatments for illnesses and injuries.

- Paramedical Services: Health insurance plans may provide coverage for paramedical services such as physiotherapy, chiropractic care, and massage therapy. These services can help with rehabilitation and recovery from injuries and chronic conditions.

- Vision and Dental Care: Health insurance plans may cover the cost of routine vision and dental care, including exams, cleanings, and basic procedures. Some plans may also provide coverage for more advanced treatments such as orthodontics and laser eye surgery.

- Hospital Stays: Health insurance plans typically cover the cost of hospital stays, including room and board, nursing care, and medical supplies. This can be especially important in the case of a serious illness or injury.

- Emergency Medical Coverage While Traveling: Some health insurance plans provide coverage for emergency medical care while traveling outside of Canada. This can include medical expenses related to illness or injury, as well as emergency medical evacuation and repatriation.

How do you choose the right Individual Health Insurance plan?

Choosing the right individual health insurance plan can be overwhelming, but our team of Health Insurance Experts can help. When choosing a plan, consider your health needs and those of your family, your budget, the reputation of the insurance provider, plan flexibility, and exclusions and limitations.

We offer plans which you can Mix & Match Benefits! Ask us today!

Why choose us for your Individual Health Insurance needs?

As a leading provider of individual health insurance in Canada, we work with top-rated insurance providers to ensure our clients have access to the most comprehensive and affordable health insurance plans available. Our team is knowledgeable, friendly, and dedicated to helping you find the right plan for your needs and budget.

Contact us today to learn more about our individual health insurance plans and how we can help you find the coverage you need to protect your health and financial future.

Ask us about Unlimited Drugs & Dental!

Claims made Easy!

-

ePay: Many health providers can submit the claim electronically on the spot; you only pay the difference.

-

eClaims: Just take a picture and submit your claim online.

Mix & Match Benefits